The Reserve Bank of India’s Monetary Policy Committee (MPC) concluded its bi-monthly meeting on [date of MPC meeting], opting to maintain the status quo on interest rates. This decision, while seemingly cautious, reflects the ongoing battle against inflation and the complexities of achieving the target of 4%.

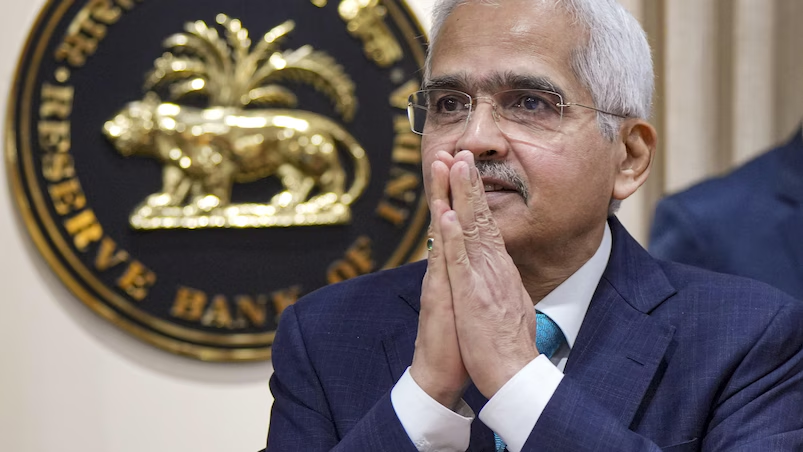

Governor Sounds a Cautionary Note

RBI Governor [Governor’s name] acknowledged the progress made in curbing inflation. However, his statement emphasized the “last mile” of the journey being “sticky.” This metaphor paints a picture of inflation proving more stubborn than anticipated, resisting further decline solely through monetary policy tools.

Inflation: A Persistent Foe

Despite recent moderation, inflation remains above the RBI’s comfortable range of 2% to 6%. Global factors like the Ukraine war and persistent supply chain disruptions continue to exert upward pressure on prices, particularly for essential items like food and fuel.

Balancing Growth with Price Stability

The MPC walks a tightrope. While high inflation erodes purchasing power and hinders economic growth, raising interest rates to combat it can also dampen economic activity. The decision to hold rates likely reflects a desire to let the effects of previous hikes play out and assess the effectiveness of existing measures.

Future Trajectory Hinges on Data

The MPC’s next move hinges on the evolving inflation story and the overall health of the economy. The Governor’s statement suggests close monitoring of incoming data. Further policy adjustments may be considered if deemed necessary to achieve the 4% target.

Key Factors to Watch

- Inflation Data: The MPC will keep a close eye on upcoming inflation figures to gauge the effectiveness of current policies.

- Global Developments: The war in Ukraine and its impact on global commodity prices will continue to be significant factors.

- Economic Growth: The MPC will strive for a balance between controlling inflation and supporting economic growth.

The Road Ahead

The RBI’s decision to hold rates underscores the ongoing challenge of achieving the desired level of inflation control. The MPC’s future actions will be determined by how inflation behaves and how the Indian economy responds to recent policy measures.

Beyond the Headline

This decision has far-reaching implications for various stakeholders:

- Borrowers: With rates unchanged, borrowing costs remain stable for individuals and businesses looking for loans. However, this might also lead to increased borrowing activity, potentially fueling inflation further.

- Depositors: Interest rates on fixed deposits and savings accounts are unlikely to see significant changes in the near future.

- The Government: The RBI’s actions will influence government spending and fiscal policy decisions as they work together to manage inflation and economic growth.

A Wait-and-See Approach

The MPC’s decision reflects a cautious approach, acknowledging progress while recognizing the remaining hurdles. The coming months will be crucial in determining the effectiveness of current measures and the need for further adjustments. As the battle against inflation continues, the RBI and the government will be closely watched as they navigate the complexities of achieving a stable and growing economy.